Worries about the potential damage hurricane season can cause are nothing new. The San Felipe-Okeechobee

Hurricane in 1928 produced winds over 150 miles per hour after making landfall in Palm Beach, Florida. More recently, 2022’s Hurricane Ian became Florida’s costliest when it inflicted

$112 billion in property damage.

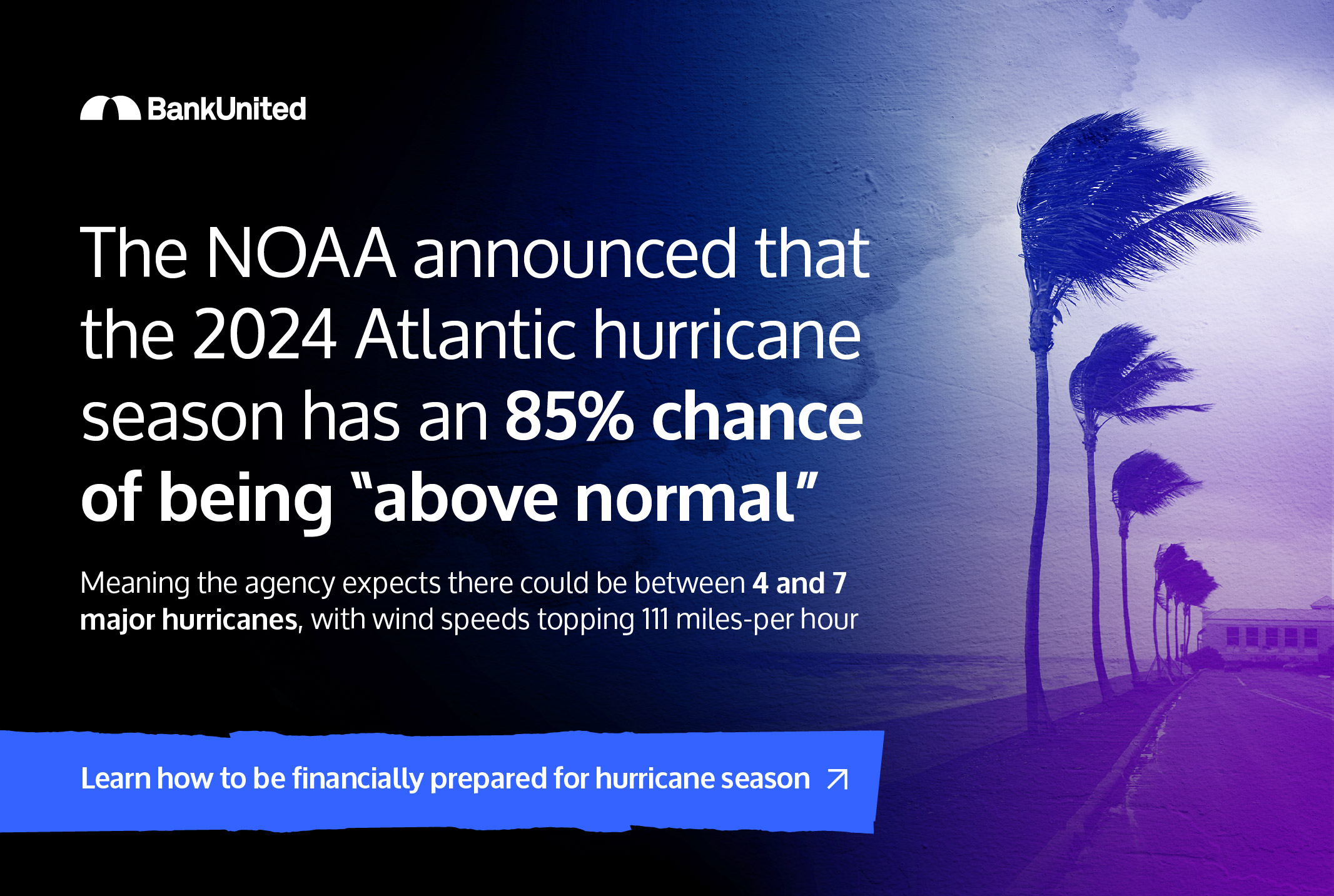

Each year, the National Oceanic and Atmospheric Administration (NOAA) releases a forecast of the number and severity of storms it expects over the course of hurricane season, which lasts from June 1 to November 30. This year,

NOAA predicts that there will be more storm activity than normal, meaning the agency expects there could be between 4 and 7 major hurricanes, with wind speeds topping 111 miles-per hour.

The potential damage hurricanes can inflict on businesses and individuals underscores the need for preparation. The U.S. Department of Homeland Security (DHS) and other government agencies

encourage people to be ready well before a storm hits, among other things, developing a family communication plan, devising an evacuation route, and assembling a basic disaster supply kit with necessities like water, food, medicine and bandages.

While these are all important and necessary steps, full preparation means considering and taking steps to address a hurricane’s potential long-term financial consequences. Here are some steps to take to get ready for hurricane season:

Step one: Understand your insurance coverage

The basic idea behind purchasing home or business property insurance is that it covers damage that individual homeowners and businesses cannot pay for on their own. Both insurance holders and insurance companies would be happy if they never had to make any claims. But that’s not the reality, which is why it’s so important to understand exactly what is and isn’t covered if a hurricane hits.

Whether it’s homeowners, business, rental, or health insurance, policies vary considerably in what they deem legitimate claims that will be paid without pushback. Heading into hurricane season, be clear about things like whether your policy will fully pay for replacement furniture and, importantly, if damage from flooding is covered. Some insurance policies include helpful benefits, like paying for temporary shelter if you’re dislocated because of a storm, which is reassuring to know and can be included as part of any evacuation plan calculations.

Step two: Inventory your possessions and secure important documents

One cause of a slow and frustrating post-storm insurance claim process is when homeowners, renters, and businesses lack proof to back up their claims. Insurance companies understandably want to verify that you own the property, equipment, and other items lost or destroyed in a hurricane.

One way to accelerate the claims process and be made financially whole quicker is to assemble the necessary documents and proof before a hurricane ever appears on the radar. To accomplish that, take photos of valuable business equipment and household items, including ownership records and deeds. It’s also helpful to retain a copy of relevant bank and investment account information to reduce the possibility that a hurricane will cause financial disruption.

Step three: Include cash in your disaster supply kit

If a hurricane is severe enough, accessing cash at a bank branch or even an ATM may be hard. That’s why it’s important to have a supply of cash stored in a readily accessible safe or lockbox that you can bring with you if you must evacuate or use until things return to normal. Additionally, being part of the Allpoint ATM network gives BankUnited customers more flexibility and options during a hurricane, as they can access cash from a wide network of ATMs even outside their immediate area. If damage is most severe in your geographic area and you can evacuate, it’s good to know exactly where you can find BankUnited branches and ATMs.

Here’s a tool to find branches and ATMs.

Step four: Consider establishing an emergency savings account

People and businesses establish dedicated savings accounts for myriad reasons, like buying equipment, the down payment on a home, or a vacation. While the severity of hurricane season varies yearly, hurricanes are an annual fact of life for Floridians. This is why it can be a good idea to open and fund a savings account to be used if you need to evacuate and stay in a hotel when a storm approaches or to cover other hurricane-related expenses. BankUnited offers a

Value Savings account that can help you save money in case of an emergency.

Take full advantage of online and mobile banking

Perhaps the biggest challenge individuals and businesses face during a hurricane is uncertainty – about the state of their property, access to cash, and the well-being of loved ones. One way to be prepared for the uncertainty about where a storm may force you to relocate temporarily is to ensure that you can manage your finances no matter where you are.

The ability to pay bills online, access accounts, and manage and move funds using a phone or laptop can maintain a sense of normalcy and control even during intense dislocation. To keep your financial life moving forward normally, be sure to

download our app and have backup payment methods like a credit card available for emergencies.

Hurricane season has the potential to be enormously disruptive. But for those who prepare in advance, financial disruption doesn’t have to be on your list of concerns.