MEDICAL INSURANCE

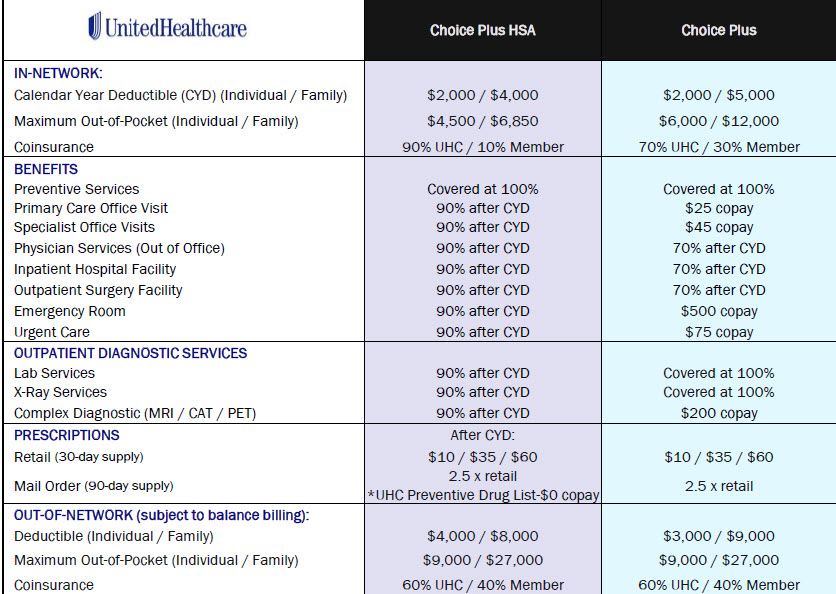

BankUnited offers two medical plans to eligible employees: The Choice Plus Plan and The Choice Plus HSA Plan. All medical plans are administered in partnership with UnitedHealthcare. All plans provide the same full coverage for preventive care services, the same comprehensive list of covered prescription drugs, as well as the same nationwide network of providers. To enroll in any of these plans during an eligible timeframe (i.e. Open Enrollment, New Hire Enrollment, or Qualifying Life Event) log in to ADP Employee Self Service Portal.

- Preventive Care Guidelines document outlines the services UHC covers at 100% for preventive care based on age and gender.

- Prescription Drug List document also known as the formulary lists all prescriptions that are covered (with applicable copays and deductible amounts to be paid) on all plans. Each medication will be categorized as a Tier 1, 2, or 3 drug for which copays are outlined in the details of each plan.

- 2025 UHC Preventative Drug List

- Vital Medications List - This is a list of UHC selected Vital Medications that BankUnited will cover at no cost to employees in any of the three medical plans.

- HSA $0 Copay Prescription List - This is a list of Preventive Medications that may be covered under your plan. If your plan covers these Preventive Medications, your insurance benefit is applied before you meet your deductible.

- Both medical plans benefit from the same nationwide network. In network providers and facilities can be found in the UHC website.

Medical Plans

| IN-NETWORK | |

| Deductible (Individual / Family) | $2,000/$5,000 |

| Maximum Out-of-Pocket (Individual / Family) | $6,000/$12,000 |

| Out-of-Pocket Max includes | copays, Rx, coinsurance, CYD |

| Lifetime Major Medical Maximum | Unlimited |

| Coinsurance | 70% |

| CO-PAYS | |

| PCP Required / Open Access | Open Access |

| Office Visits/Consultations for Illness/Injury | $25 |

| Specialist Visits | $45 |

| Physician Services (Out of Office) | 70% after CYD |

| Inpatient Hospital | 70% after CYD |

| Outpatient Surgery | 70% after CYD |

| Emergency Room | $500 |

| Urgent Care | $75 |

| OUTPATIENT DIAGNOSTIC SERVICES | |

| Lab Services | 100% |

| X-Ray Services | 100% |

| Complex Diagnostic | $200 |

| PRESCRIPTIONS | |

| Retail (30 Day Supply) | $10/$35/$60 |

| Mail Order (90 Day Supply) | 2.5 x retail |

| OUT-OF-NETWORK | |

| Deductible (Individual / Family) | $3,000/$9,000 |

| Maximum Out-of-Pocket (Individual / Family) | $9,000/$27,000 |

| Lifetime Major Medical Maximum | Unlimited |

| Coinsurance | 60% |

Things to Know:

- The Family deductible is $2,000 per person up to a family maximum of $5,000.

- Co-pays do not count towards deductible.

- Out of network services are still subject to balance billing.

Resources:

- Summary Plan Description (SPD) - A Summary Plan Description provides a deeper dive into all covered and excluded benefits as required by law.

- Summary of Benefits and Coverage (SBC) - An easy to read Summary of Benefits and Coverage (SBC) that lets you make apples to apples comparisons of costs and coverage. The SBC shows how the cost for covered health services would be shared with the health plan.

| IN-NETWORK | |

| Deductible (Individual / Family) | $2,000/$4,000 |

| Maximum Out-of-Pocket (Individual / Family) | $4,500/$6,850 |

| Out-of-Pocket Max includes | copays, Rx, coinsurance, CYD |

| Lifetime Major Medical Maximum | Unlimited |

| Coinsurance | 90% |

| CO-PAYS | |

| PCP Required / Open Access | Open Access |

| Office Visits/Consultations for Illness/Injury | 90% after CYD |

| Specialist Visits | 90% after CYD |

| Physician Services (Out of Office) | 90% after CYD |

| Inpatient Hospital | 90% after CYD |

| Outpatient Surgery | 90% after CYD |

| Emergency Room | 90% after CYD |

| Urgent Care | 90% after CYD |

| OUTPATIENT DIAGNOSTIC SERVICES | |

| Lab Services | 90% after CYD |

| X-Ray Services | 90% after CYD |

| Complex Diagnostic | 90% after CYD |

| PRESCRIPTIONS | After CYD: |

| Retail (30 Day Supply) | $10/$35/$60 |

| Mail Order (90 Day Supply) | 2.5 x retail |

| OUT-OF-NETWORK | |

| Deductible (Individual / Family) | $4,000/$8,000 |

| Maximum Out-of-Pocket (Individual / Family) | $9,000/$27,000 |

| Lifetime Major Medical Maximum | Unlimited |

| Coinsurance | 60% |

Things to Know:

- High Deductible Health Plan/ Health Savings Account (2 Part plan).

- Family Deductible is a household deductible meaning covered household participants may contribute towards meeting it.

- Out of network services are subject to balance billing.

- BankUnited Contributes $1,000 to all employee HSA accounts (prorated after January).

- Rx subject to deductible (unless listed on $0 copay list – see link below).

- Office visits are subject to deductible.

- Not an HMO plan. Participants are free to see any in-network provider without referral.

Resources:

- Health Savings Account Information: The HSA medical plan is paired with a free BankUnited (HSA) Health Savings Account. This is considered a tax advantaged account with numerous benefits and therefore is subject to IRS rules. Learn more about how to start and use an HSA to maximize it’s benefits in the Tax Advantaged Accounts Section.

- The HSA $0 Copay List: The drugs listed on this document are covered at absolutely no cost to the HSA plan participants. This list is an addition to the already existing formulary of covered prescription drugs for all BankUnited medical plans.

- An easy to read Summary of Benefits and Coverage (SBC) that lets you make apples to apples comparisons of costs and coverage. The SBC shows how the cost for covered health services would be shared with the health plan.

- Summary Plan Description: A Summary Plan Description provides a deeper dive into all covered and excluded benefits as required by law.

Medical Plans Comparison