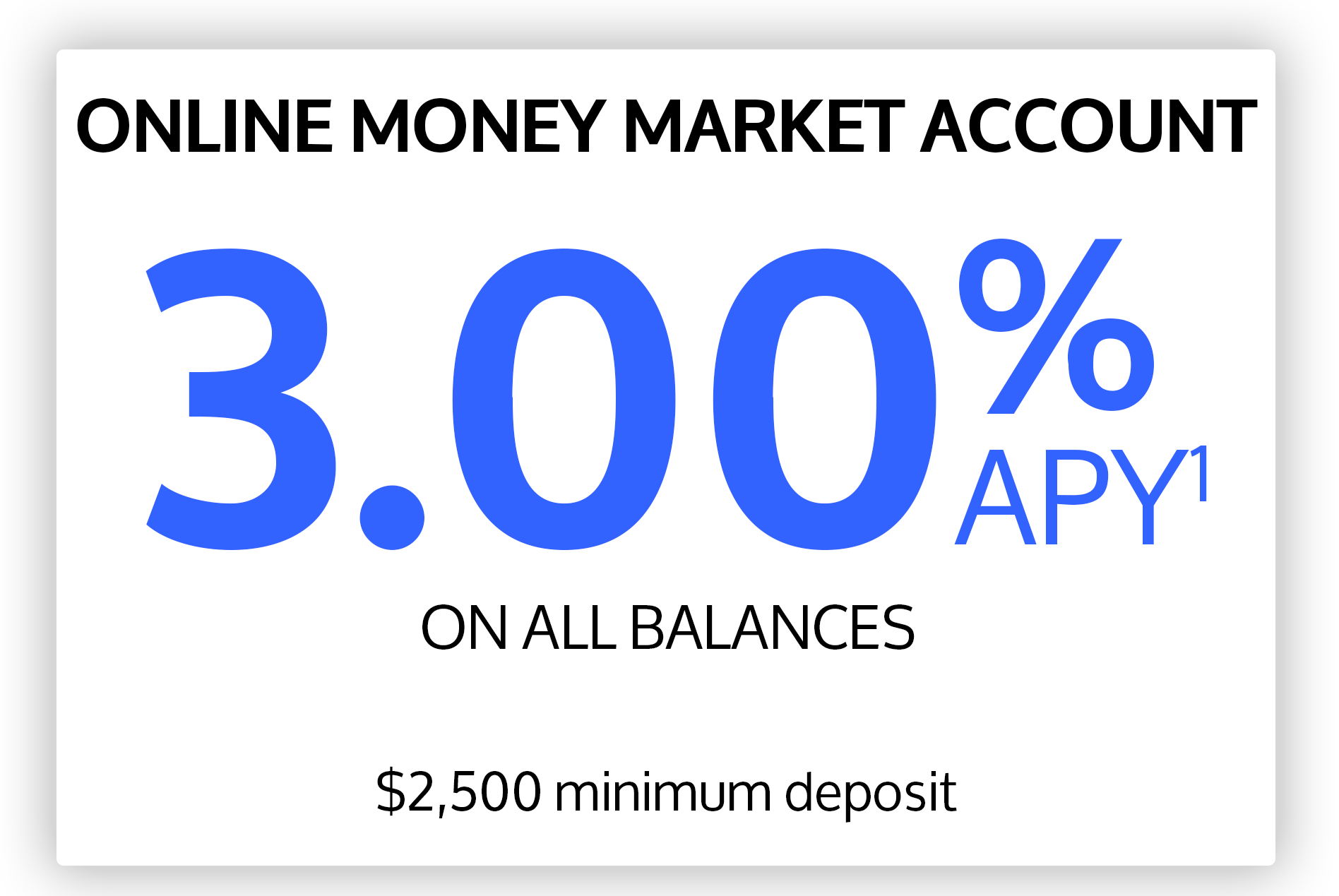

MONEY MARKET ACCOUNTS

Grow Your Savings Your Way

Save more with competitive rates and flexible terms.

If you're an existing customer, please log into your online banking for a faster, prefilled application experience. Login to Online Banking

MAXIMIZE YOUR SAVINGS POTENTIAL

TRANSACTION FLEXIBILITY

Make unlimited transactions with no fees and unlimited deposits.

AUTOMATIC

TRANSFERS

Set up automatic monthly transfers from your checking account.

FDIC

INSURED

Your deposits are FDIC insured up to the maximum allowable limits.†

EASY ACCOUNT MANAGEMENT

Manage your account anywhere, any time on the BankUnited mobile app.

SAVE FOR WHAT'S IMPORTANT TO YOU

![]()

.png?sfvrsn=832a633_1)

From building an emergency fund or saving for a particular purchase, our money market account can get you closer to your financial goals.

- $2,500 minimum opening deposit

- Monthly maintenance fee waived when you maintain a minimum daily balance

- Unlimited transactions

- Easy fund transfers with online and mobile banking

A SAFE PLACE TO GROW YOUR MONEY

At BankUnited, security is our top priority.

5-star rating from

Bauer Financial

Member FDIC

START SAVING FOR SOMETHING GREAT

Open your account today in 3 easy steps

START YOUR APPLICATION

Tell us some basic information (like your address, contact number and social security number). We will never compromise your information.

FUND YOUR ACCOUNT

Send your money via mobile deposit or secure online transfer. The minimum opening deposit is $2,500.

WATCH YOUR MONEY GROW

Download the BankUnited mobile app or log in to your online banking account to manage your funds at your convenience.

If you're an existing customer, please log into your online banking for a faster, prefilled application experience. Login to Online Banking

TAKE YOUR ACCOUNT WITH YOU WHEREVER YOU GO

Manage your account anytime from the BankUnited mobile app.

- Track your earnings

- Transfer funds

- Pay bills

- Deposit checks

- And much more...

Rated 4.7 out of 5 stars!

Are my accounts with BankUnited FDIC insured?

BankUnited accounts are insured up to the maximum limits through the Federal Deposit Insurance Corporation (FDIC). If you want to learn more about FDIC insurance limits, click here.

1 Annual Percentage Yield (APY) is accurate as of 12/23/2024. The interest rate and APY are variable and are subject to change at any time before or after account opening at our discretion without notice. Minimum to open the account is $2,500.00. Maximum opening deposit per account is $250,000.00. A $15.00 monthly maintenance fee will be assessed if the daily balance falls below $2,500.00. A $15.00 early closeout fee will be assessed if the account is closed within 180 days of opening date. Fees may reduce earnings. Transaction limitations apply. Additional fees, terms and conditions may apply. Please refer to our Depositor’s Agreement and applicable Schedule of Fees for additional information. Advertised rates are for accounts opened online through BankUnited.com only. Other rates may be in effect for accounts opened in person at a BankUnited branch, by mail or other remote means. Please contact a BankUnited representative at (877) 779-2265 for additional details. Offer is for consumer accounts only.

† To the maximum allowed by law. For more information about FDIC insurance coverage please visit www.fdic.gov.

Leave a commentOrder by

Newest on top Oldest on top